Objective: Through the

daily transaction data, compute the shares rising for 5 consecutive days from

29 blue chips.

Train of Thoughts: Import

data; Filer out the data of previous month; Group by the code of shares; Sort

the data by the date; Calculate the daily increment of the closing price based

on the comparison to that on the previous day; Calculate the days of

consecutive positive growth; Filter out the shares whose positive rising days

are greater or equal to 5.

Row data: Downloading the

transaction data of shares about the major blue chips from a financial website.

They are more than 29 listed public companies and put the data in Excel:

esProc

Solution

A1: Retrieve data from Excel. The whole process will take about 20-30

seconds. After all, there are more than 200 thousand rows of data in total.

A2: Filter the data by date. Only need the transaction data in a

month.

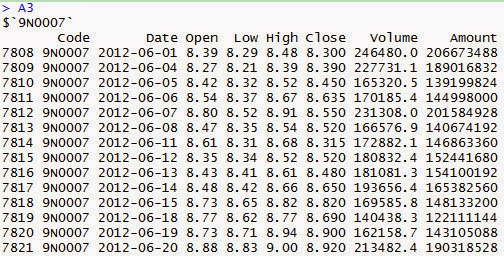

A3: =A2.group(Code) is to group by the code of shares. This is similar

to the split function of R, and you can view the calculation on the right by

clicking on this cell:

Each row is a group, and you can view the

data in the group by clicking one of the rows:

A4: =A3.(~.sort(Date)), to sort the transaction data of the shares of

each company by transaction date.

This is because whether the downloaded data

having been sorted in advance is not confirmed and the inter-row computation

followed can only be conducted on the sorted data.

A5: =A4.(~.dup@t()), to structuralize

the data (the TSeq in esProc) to add the new column dynamically in the next

steps.

A6: =A5.(~.derive((Close-Close[-1]):INC)) to calculate on the shares of

each company through ”Closing price today”-“Closing price previous day”.

This

is a newly-appended column with the name “NC”. It is quite obvious that INC

above 0 indicates the shares price is rising, and below 0 indicates the shares

price is on decline.

A7: =A6.(~.derive(if(INC>0,CID=CID[-1]+1,0):CID)) to add a new column

CID to record the consecutive rising days to this date.

If the shares price is

rising (INC>0), then add 1 to the CID of the previous day as the CID of this

day; On the contrary, if the shares price is dropping, then the CID of this day

will be reset to 0.

A8: =A7.select(~.max(CID)>=5) to filter. If the greatest consecutive

rising days of a certain shares are equal or greater than 5, then it is the

shares of good quality. The symbol of ~ represents every group (i.e. shares of

every company). In this way, most loop statements become unnecessary.

The

result is shown below:

A9: =A8.(~.Code) to retrieve the code of company shares, that is, the

Code in each group. The result is shown below:

R Solution

01 library(gdata)

#use excel function library

02 A1<-

read.xls("e:\\data\\all.xlsx") #import data

03 A2<-subset(A1,as.POSIXlt(Date)>=as.POSIXlt('2012-06-01')

& as.POSIXlt(Date)<=as.POSIXlt('2012-06-30')) #filter by date

04 A3

<- split(A2,A2$Code) #group by Code

05 A8<-list()

06 for(i

in 1:length(A3)){

07 A3[[i]][order(as.numeric(A3[[i]]$Date)),]

#sort by Date in each group

08 A3[[i]]$INC<-with(A3[[i]],

Close-c(0,Close[- length (Close)])) #add a column, increased price

09 if(nrow(A3[[i]])>0){ #add a column, continuous increased days

10 A3[[i]]$CID[[1]]<-1

11 for(j in 2:nrow(A3[[i]])){

12 if(A3[[i]]$INC[[j]]>0 ){

13

A3[[i]]$CID[[j]]<-A3[[i]]$CID[[j-1]]+1

14 }else{

15 A3[[i]]$CID[[j]]<-0

16 }

17 }

18 }

19 if(max(A3[[i]]$CID)>=5){ #stock max CID is bigger than 5

20 A8[[length(A8)+1]]<-A3[[i]]

21 }

22 }

23 A9<-lapply(A8,function(x)

x$Code[[1]]) #finally,stock code

01: Enable the support for Excel. Please note that third party package

is required for R to support Excel. Therefore, it is not easy to find a compatible

package.

02: Import the data from

Excel. Perhaps this downloaded package is not working very well, this procedure

takes about 8 - 10 minutes. The memory taken by Perl is several hundreds

megabytes more than that of esProc. Despite it, the operation speed of R itself

is actually quite high and the performance of retrieving the data from database

well proves it.

03, 04: Filter by date,

and group by Code. Seeing the grouped data, you may find it a bit hard to

understand. After clicking the variables on the right, the result will be as

shown below:

It will

be even better if inputting commands on the console directly, as given below:

05: A8<-list() to

define a variable A8 of list type, which will be used to store the shares

rising for 5 or more days.

06-22: Because R does not

allow for using ~ to represent the operation on each group like we do in

esProc, a big loop is unavoidable, and each loop is aimed to calculate for the

shares of one company.

07: Sort by date. If

sorted before grouping, the code would be simpler. The most intuitive situation

in my mind is that data is mixed up before grouping and you can not determine

if they are sorted.

After grouping, you will find that the order is a bit messy

and the inter-row calculation in the next step cannot be conducted if not

sorting.

08: Add a column INC to calculate the “Closing price this day”–“Closing

price previous day”. R does not support the inter-row calculation. Therefore,

move the whole section of closing prices downward by one row, and then substrate

the original closing price. The code is: Close-c(0,Close[- length (Close)]).

09-18: Add a column CID to calculate the consecutive rising days. The if(nrow(A3[[i]])>0)

in the row 09 is to avoid the error of null pointer resulting from any shares without

any data due to the temporary suspension or other reasons.

The A3[[i]]$CID[[1]]<-1

in the row 10 is to assign the initial value and avoid the error of null

pointer followed. esProc does not require users to carry out any similar tests

and is more friendlier to the non-technical and professional personnel than R.

11-17: Calculate the consecutive rising

days. Although the necessary codes are not a few, the algorithm is same to that

of esProc.

19-21: Filter. If the

longest consecutive rising days of a certain share are equal or greater than 5,

then it is the shares of good quality. Though there are quite a few lines of

codes, the algorithm is quite different to the esProc. The result is as shown

below:

23:Get the code from the

group, A9<-lapply(A8,function(x) x$Code[[1]]), as shown in the below figure:

Findings:

Both R and esProc can implement some rather

complex shares analysis with its own capability. The code of esProc is simpler

and easier-to-understand and thus it avoids most loop statements. The user-friendly

esProc mechanism and process has been setup for the aspect in which the error

may easily occur. Generally speaking, you will know how to analyze shares with

esProc as long as you know how to use the basic Excel formulas.

To complete the shares analysis with R,

users must be skilled in programming and have learned some mathematical

knowledge so as to implement every function of R flexibly. R also has the

outstanding scalability, for example, the 3rd party library function and statistical

chart for stock markets; for another example, R allows users to write a

function to retrieve the Excel data more efficiently.

more: http://blog.raqsoft.com

No comments:

Post a Comment